FDA's First Green Light for New Heart Failure Drug in Recent 4 Years

2023-05-27 16:15:32Sotagliflozin, abandoned by Sanofi, has become the first SGLT1/2 dual inhibitor approved by the FDA, with its efficacy in heart failure surpassing that of SGLT2 single target inhibitors.

The FDA, which has always had strict requirements for clinical study data on chronic disease medications, has recently been particularly lenient towards a new drug.

Last Friday, Lexicon Pharmaceuticals announced that its product, Sotagliflozin has been approved by the FDA to reduce the risk of cardiovascular death, hospitalization for heart failure, and urgent heart failure visit in adults.

The two studies SOLOIST and SCORED submitted for Sotagliflozin, only included patients with type 2 diabetes. Surprisingly, the FDA did not ultimately limit whether users suffered from diabetes or left ventricular ejection fraction (LVEF).

Dual SGLT1/2 inhibitor, Sotagliflozin Index comprehensively surpasses the other marked selective SGLT2 inhibitors

This time, the FDA has expanded the scope of indications for Sotagliflozin to include populations outside of the study group. It is speculated that this is based on the research experience with similar SGLT2i products, and more importantly, it should also demonstrate the therapeutic advantages of SGLT1/2 dual inhibitors compared to SGLT2 single target inhibitors.

In recent years, while SGLT2 inhibitors have been developed as hypoglycemic drugs, they have unexpectedly shown preventive and therapeutic effects on heart failure, therefore becoming an important breakthrough in the field of new drug research and development.

Since 2020, multiple SGLT2 inhibitors have been approved by the FDA for heart failure indications, such as Empagliflozin and Dapagliflozin. The coverage of indications has gradually expanded from heart failure with reduced ejection fraction to heart failure with preserved ejection fraction.

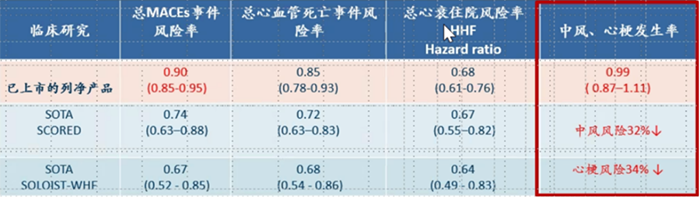

The FDA's requirement for heart failure drugs is "Three Good Students". Specifically, approved products must demonstrate therapeutic benefits in three main endpoints, including the overall risk rate of Major Adverse Cardiovascular Events (MACEs) cardiovascular death events, and total heart failure hospitalization.

In all three of these endpoints, Sotagliflozin showed significant differences compared to the placebo group, and the data also indicated great improvement over other "flozin” class products already on the market (see the table below).

In addition, the most significant improvement of Sotagliflozin is reflected in reducing the risk of stroke and myocardial infarction events. From the data, the SGLT2 inhibitors currently on the market cannot provide benefits for patients in this specific endpoint, while Sotagliflozin reduces the incidence of both events by more than 30%.

Sanofi didn't make it to the end

The design concept of SGLT1/2 dual target inhibitor is to simultaneously reduce glucose absorption in the gastrointestinal tract and glucose reabsorption in renal tubules, serving the purpose of further reducing the glucose absorption of diabetes patients, and providing better treatment options for people with renal impairment.

Sanofi had high hopes for the development of the above products in the field of diabetes. In November 2015, Lexicon and Sanofi signed a cooperative development agreement to obtain the global development and commercialization rights for Sotagliflozin. The cooperation has an upfront payment of $300 million, along with $1.4 billion in milestone payments and a certain proportion of sales share.

Sanofi's decision at that time could not be attributed to a gambler’s mentality, as several blockbuster SGLT2 single-target inhibitors had already been launched. They didn’t expect that the development of SGLT1/2 dual target inhibitor in the indication of diabetes would be so bumpy.

The initial indication for sotagliflozin suffered a setback in its application for market approval by the FDA. After reaching cooperation agreement with Sanofi, several clinical studies were conducted with Sotagliflozin in type 1 diabetes, and it was approved by the European Union in April 2019 for adult patients with type 1 diabetes who received the best insulin therapy but still failed to achieve blood glucose control.

However, the FDA rejected sotagliflozin for the market due to concerns about the potential risk of diabeticketoacidosis (DKA). In fact, SGLT2 inhibitors had not been approved as an indication for type 1 diabetes for the same reason, and Sotagliflozin failed to overcome.

The results of several clinical studies conducted on Sotagliflozin for type 2 diabetes were mixed. In the study involving patients with renal impairment, which best illustrates the advantages of dual SGLT1/2 inhibitors, compared with selective SGLT2 inhibitor, Sotagliflozin showed much better hypoglycemic control in diabetes patients with mild and moderate renal impairment (less than DKD3a), but failed to show much more significant clinical benefits to type 2 diabetes patients with more severe kidney injury (DKD3b and above).

This became the last straw that crushed Sanofi's confidence.

In 2019, Sanofi announced the termination of its cooperation with Lexicon on the Sotagliflozin project, and paid Lexicon a breakup fee of $260 million for this purpose. Lexicon, due to lack of funds, was unable to continue advancing multiple Phase 3 clinical studies that had already been initiated, including two large-scale clinical studies, SOLOIST and SCORED. Therefore, it had to submit a heart failure indication listing application to the FDA in 2021 using mid-term analysis results.

Faced with the news that Sotagliflozin has been approved for indications for heart failure after 4 years, how would Sanofi feel at this time?

According to GlobalData's prediction, by 2028, there will be only eight major markets alone worldwide (the United States, France, Germany, Italy, Spain, the United Kingdom, Japan, and China), will see a compound annual growth rate of 19.5% in the heart failure drug market. It is expected that the market size will reach $22.1 billion by 2028.

Similar and better products in China

In addition to the approved Sotagliflozin, there are two SGLT1/2 dual target inhibitors entering the clinical study stage globally, namely Novartis' LIK066 and Youngene Therapeutics' YG1699.

Among them, YG1699 from Youngene Therapeutics is the only SGLT1/2 dual target inhibitor developed in China that has entered clinical study. The company mentioned that in 2022, YG1699 has received FDA approval to directly initiate phase 2 clinical study for heart failure indication in the United States.

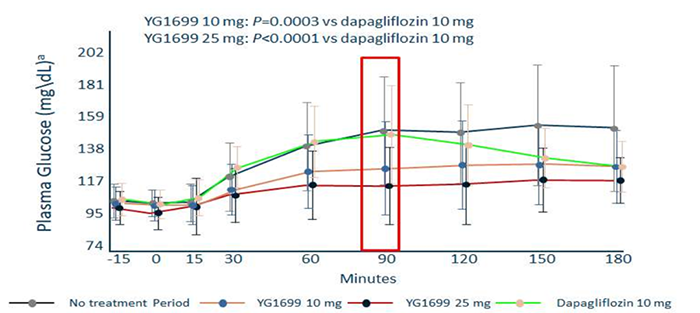

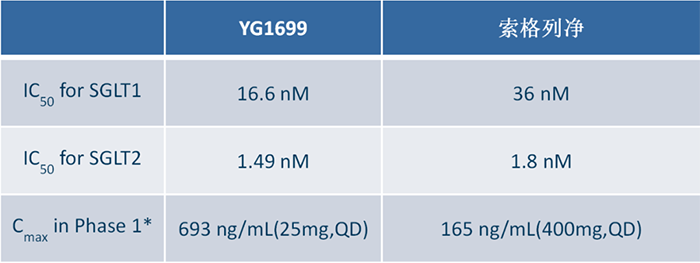

Dr. Li Chenghai, COO of Youngene Therapeutics, said: YG1699 has multiple advantages compared to Sotagliflozin (data obtained during the same period), as it is much better than Sotagliflozin in terms of safety window, human PK exposure, and biological activity. For the commonly concerned ketoacidosis (DKA) of Sotagliflozin in the industry Question: In the completed Phase 2 clinical study of T1DM treatment with YG1699, there were no cases of DKA reported during the study. The study results also show that the efficacy of YG1699 is significantly better than that of Dapagliflozin in head- to -head comparison. (Specific data is shown in the figure below)

(In the figure, the vertical axis represents postprandial blood glucose, and the horizontal axis represents time. The dark gray line represents the control group, the green line represents 10mg of Dapagliflozin, and the orange and red lines represent 10mg and 25mg of YG1699, respectively. The figure shows that the blood sugar levels of the two groups without medication and those using Dapagliflozin increased within 90 minutes. Starting from 90 minutes, Dapagliflozin takes effect and begins to lower blood sugar. Both 10mg and 25mg of YG1699 take effect immediately after taking the medication and maintain a stable blood sugar level. Experiments have shown that YG1699 is superior to Dapagliflozin in reducing blood sugar and controlling postprandial blood sugar stability.)

According to the information provided by Youngene Therapeutics, YG1699 has a higher human PK exposure (see the table below), and at a dosage of 25mg, the blood drug concentration can reach four times that of Sotagliflozin at a dosage of 400mg.

It is also worth mentioning that Pablo Lapuerta, the current Chief Medical Officer of Youngene Therapeutics, has previously served as the Global Executive Vice President and CMO at Lexicon, leading multiple clinical developments of Sotagliflozin.

The approval of Sotagliflozin in the field of heart failure has increased the confidence of domestic SGLT1/2 dual target inhibitor developers in China. Next, the company will initiate large-scale global phase 3 clinical trials, which will require a significant investment of funds and manpower support.

What other indications can SGLT1/2 dual target inhibitors bring forth in the future, and what the future clinical research results of YG1699 will demonstrate, are all worth looking forward to.